ABOUT

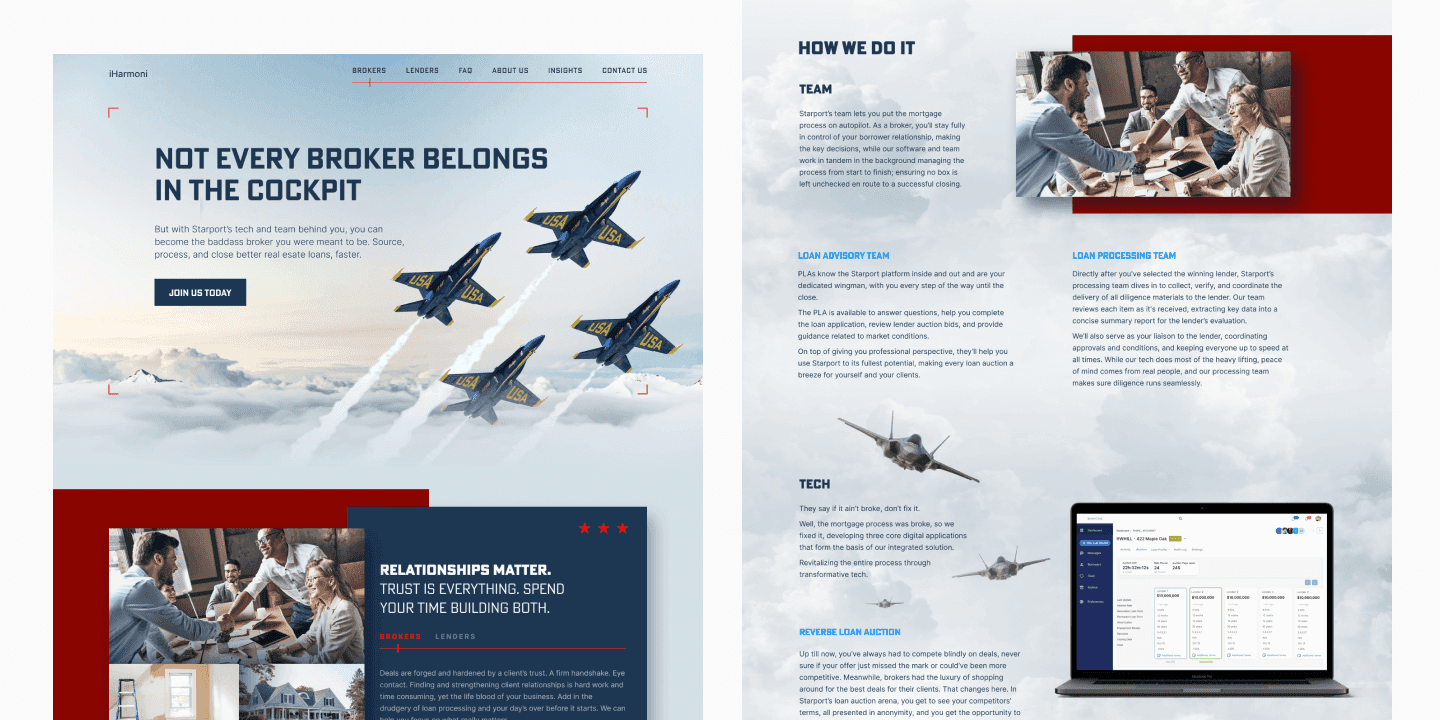

Starport is a groundbreaking platform that connects borrowers, brokers, and lenders, providing borrowers with a smart and efficient way to secure the most profitable deals from lenders. By leveraging cutting-edge technology, Starport revolutionizes the borrowing process by offering features like reverse auctions, smart matching algorithms, and streamlined due diligence management.

With Starport, borrowers can conveniently communicate with brokers, access loans from multiple lenders, and efficiently manage the loan deal workflow for maximum profitability.

BUSINESS CHALLENGE & SOLUTION

The main challenge we addressed was the need to provide borrowers with a convenient and unique way to connect with brokers and obtain loans from different lenders with the most favorable terms. We recognized the complexity and inefficiency of the traditional borrowing process and aimed to streamline it through innovative solutions.

Our approach involved developing a robust platform that incorporates reverse auctions, where lenders compete to offer the best terms, and smart matching algorithms that connect borrowers with the most suitable lenders based on their specific needs.

SOLUTION

A Digital Platform that Powers Mortgage Brokers

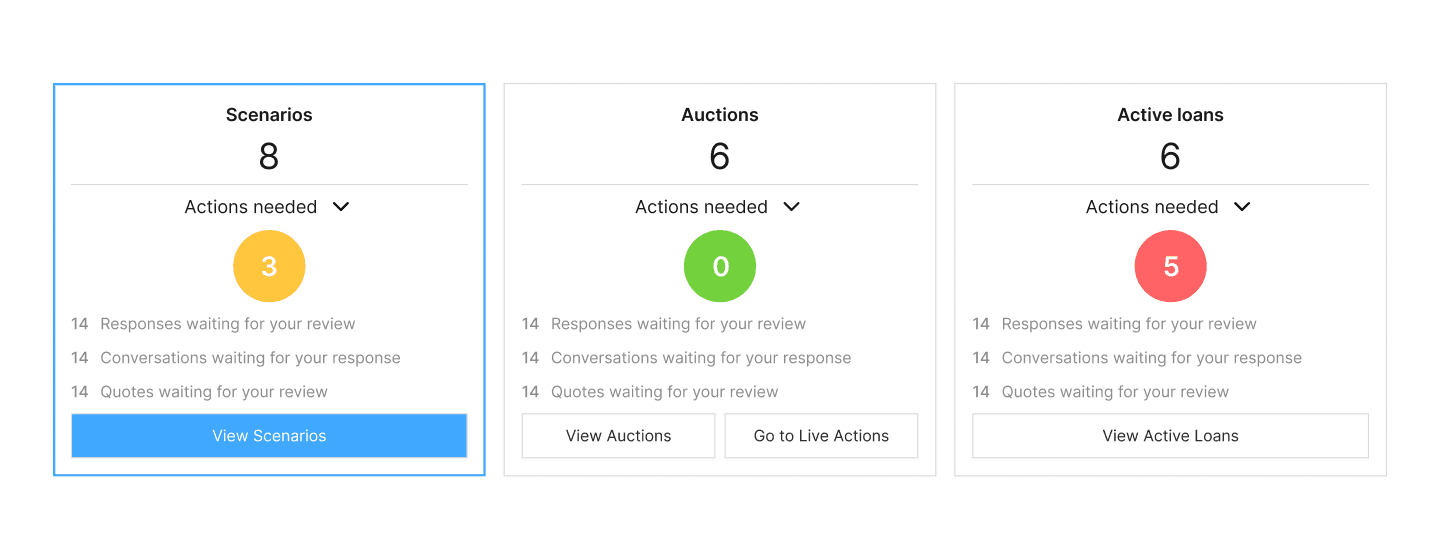

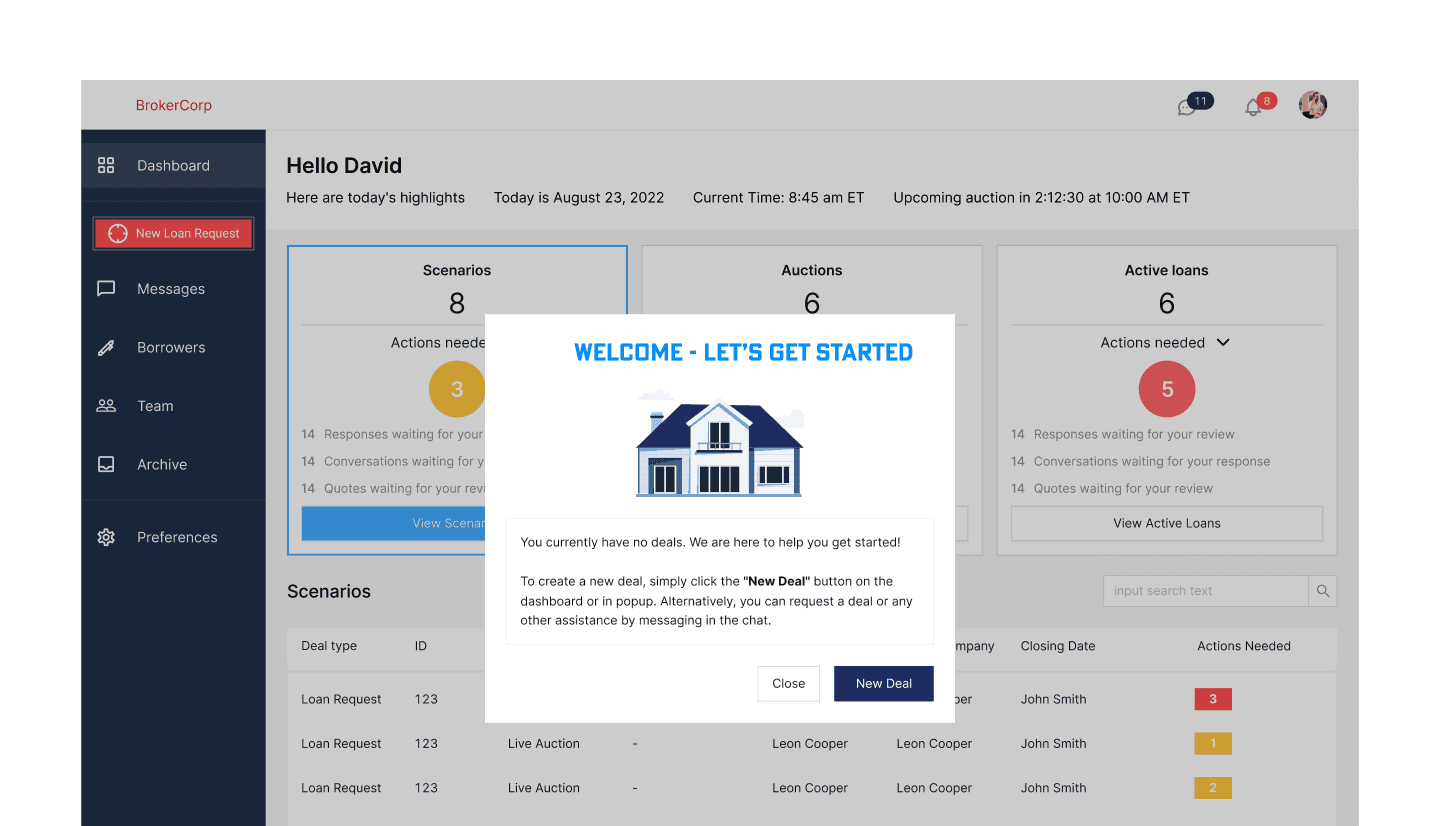

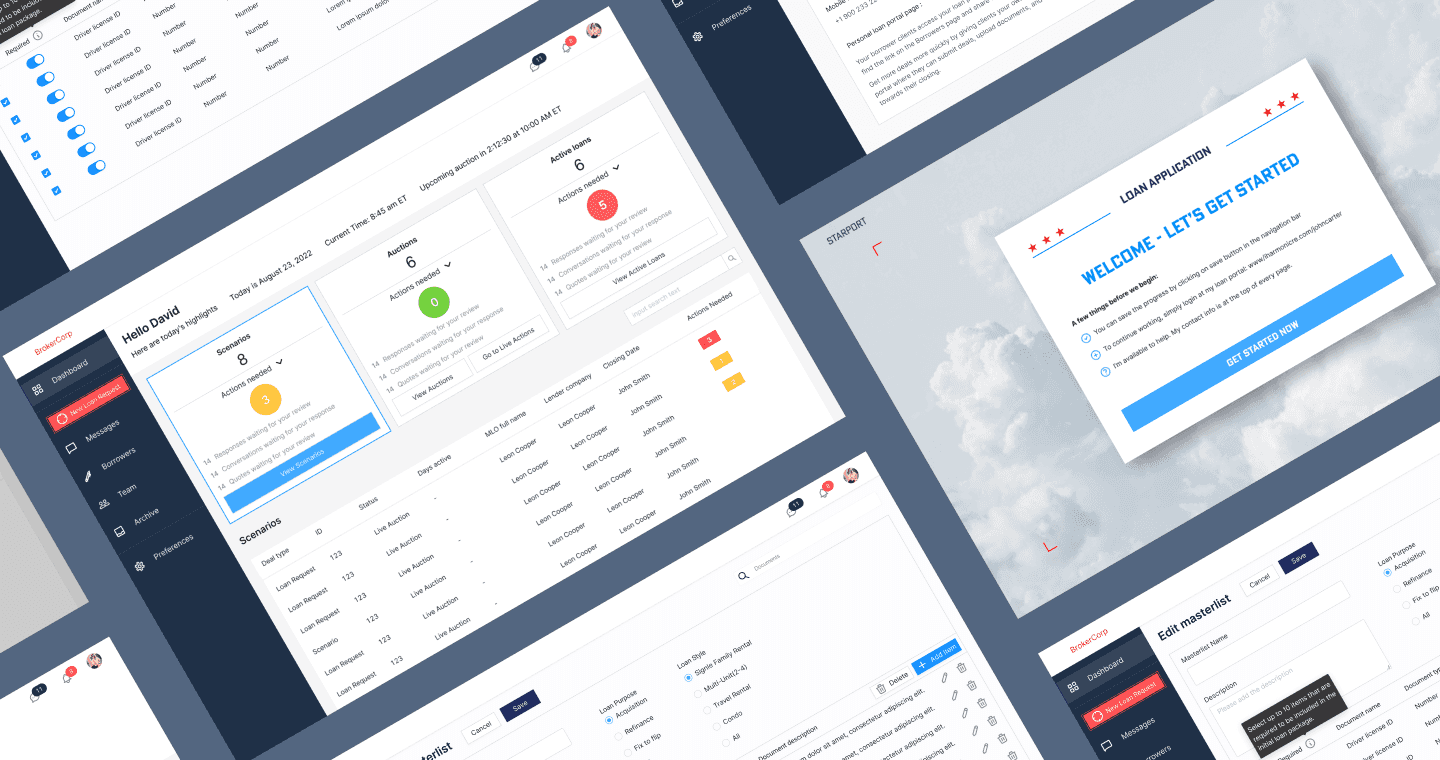

Our solution, Starport, is a cutting-edge platform that redefines the borrowing experience. Through reverse auctions and smart matching algorithms, we empower borrowers to connect with brokers and access loans from a network of lenders, ensuring they secure the most profitable deals. The platform's user-friendly interface provides a seamless experience, allowing borrowers to easily navigate and interact with the system.

A key feature of Starport is the streamlined due diligence management, which simplifies the loan deal workflow. Borrowers can efficiently manage documentation, track progress, and collaborate with brokers and lenders, ensuring a smooth and timely loan process. By automating tedious tasks and providing real-time updates, Starport enhances transparency, reduces manual errors, and accelerates the loan closing process.

With Starport, borrowers have a convenient and unique way to navigate the borrowing landscape, benefiting from competitive loan offers and efficient deal management.

TECHNOLOGIES AND TOOLS

Instruments & Services

DESIGN

MANAGEMENT

DEVELOPMENT

CUSTOMER OUTCOME

Maximizing Profitability and Efficiency

Through our collaboration with Starport, we have achieved the customer outcome of maximizing profitability and efficiency for borrowers. By connecting borrowers, brokers, and lenders through our cutting-edge platform, we have revolutionized the borrowing process. Borrowers can now access a network of lenders, leveraging reverse auctions and smart matching algorithms to secure the most profitable loan deals.

The streamlined due diligence management feature provides borrowers with centralized control and transparency over the loan deal workflow. They can easily track progress, collaborate with brokers and lenders, and efficiently manage documentation, resulting in accelerated loan processing and reduced manual errors.

Starport empowers borrowers to make informed decisions and optimize profitability. By simplifying and automating the borrowing process, borrowers can focus on their financial goals and confidently navigate the lending landscape. With Starport, borrowers can access the most favorable loan terms, close deals efficiently, and achieve their borrowing objectives with ease.